If you’re debating whether or not to trust payment links, or are considering implementing a pay-by-link strategy in your own business, we’ll tell you all you need to know.

- What are payment links?

- Are payment links safe?

- How can I create a payment link?

What are payment links?

By definition, a hyperlink or link is an asset you can interact with that will take you from one page to another. A payment link specifically starts a transaction online, either through a URL or a QR code. Using the link, either by clicking or scanning it, will let you access a payment page (also known as payment portal), where you simply enter any payment details not already included and complete the transaction. Payment links are easily one of the most convenient checkout methods currently available, and can either be specific to a single transaction or tied to a recurring product or service.

A payment link differs from a set payment form because it can go wherever your customers go. URLs or QR codes can be attached to text messages, direct messages, live chats, emails, or embedded on web pages and even directly onto professional quotes.

Are payment links safe?

Real and/or non-fraudulent payment links connect to secure payment gateways that use encryption and tokenization to protect your payment data.

That being said, not all companies that send you a payment link will be trustworthy. It’s important to use your best judgment and do some research before clicking anything your receive. As a customer, continue purchasing goods and services from trusted businesses that you know are implementing security measures.

Businesses, on the other hand, should choose a payment provider that adheres to Payment Card Industry data security standards (PCI DSS).

What should I do to make sure a payment link is safe?

- Make sure there is an HTTPS at the start of the URL.

- Check if the business has fraud prevention methods and certifications.

- Never enter financial data when using a public WiFi network.

Another factor to keep in mind when it comes to payment link safety is whether or not you were expecting a payment link in the first place. If you weren’t expecting to receive a payment link, it could potentially be fraudulent and you should avoid clicking or scanning it.

How can I create a payment link?

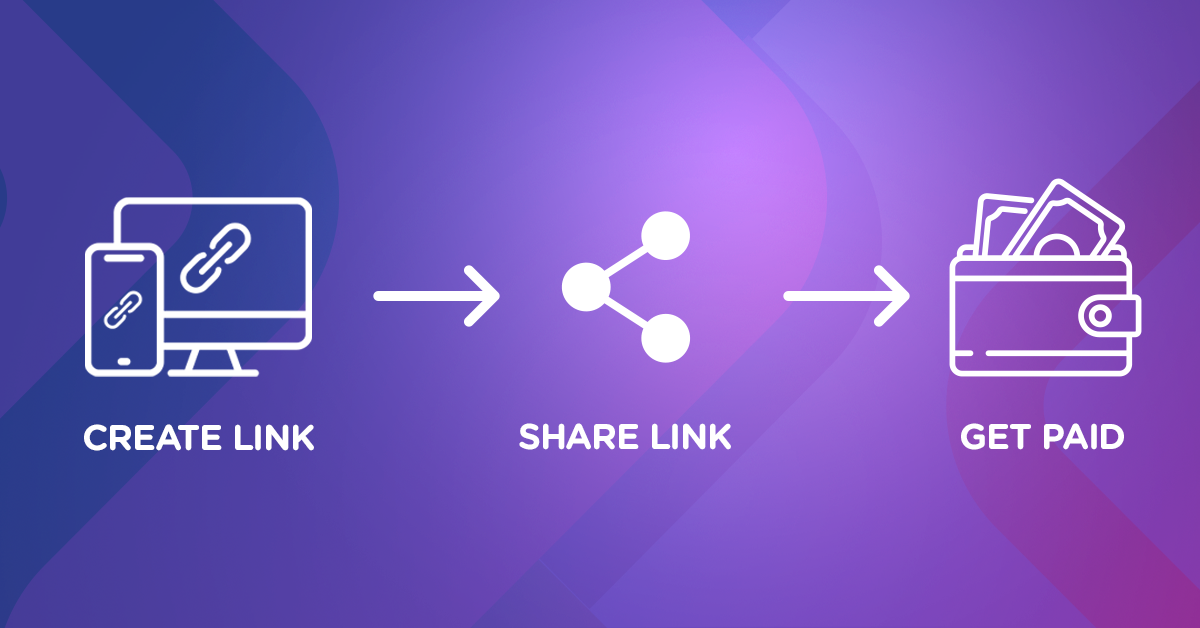

Much like when accepting credit cards or ACH payments, the first step is to find a payment services provider or PSP. The steps you take from there depend on the provider’s specific services. The following are the general steps of the link creation process:

- First, create an account. This process should be done before you need to start accepting payments since it can involve a credit check or underwriting process which may take some time.

- Second, create the payment link. This is where you’ll add billing details and terms, as well as who will have access to the link.

- Finally, send the link. You’re now able to send the payment link to your customers.

Payment links greatly simplify the payment process, and when you make it more convenient for your customers to make a payment, receiving money becomes easier for you too. For more information on Accepta’s convenient and secure payment processing solutions, contact us at (787) 774-1555 or visit us at www.accetapayments.com