Merchants should verify the legitimacy of the payment transactions they process to prevent fraud.

For card-present transactions, you can simply request valid photo identification and make sure that the name and face matches the cardholder.

However, for card-not-present transactions, it is more complicated. Without a legal ID verification, it’s easier for ill-intentioned individuals to make unauthorized charges using someone else’s credit card number, even if they don’t have the card itself present. Measures such as the Address Verification System (AVS) and the Card Verification Value (CVV) can be used in these cases to confirm the cardholder’s identity, assess the transaction’s validity, and reduce costs.

- Address Verification System (AVS)

AVS is a security tool that cross-references the billing address entered during the transaction and the one on the cardholder credit card company files. If the card number is stolen, the individual performing the transaction likely won’t have access to the legitimate address. Card brands like Visa, MasterCard and American Express support AVS.

- Card Verification Value (CVV)

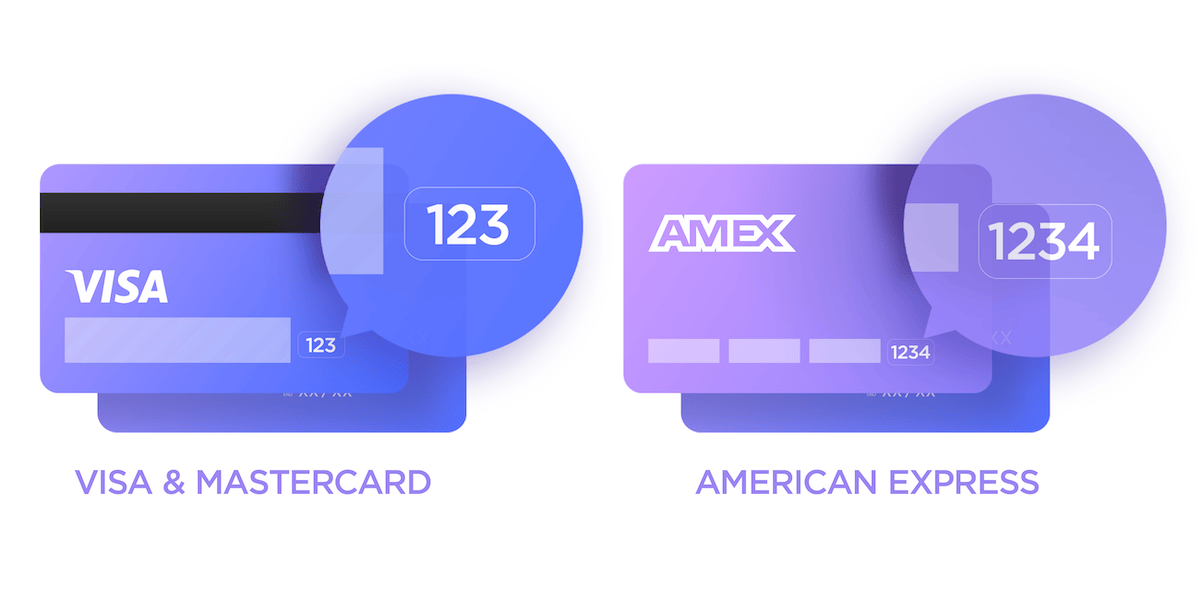

The CVV code is a number printed on credit cards that serves as evidence that the customer has said card physically in their possession. For Visa and MasterCard, it’s a 3-digit number on the back of the card, while American Express has a 4-digit number printed on the front of the card. This authentication measure is crucial in credit card security and fraud prevention, protecting both the customer’s data and the merchant.

Other names frequently used for the Card Verification Value are Card Security Code (CSC) and CVV2. It’s important to note that CVV numbers are not the Personal Identification Numbers (PINs). You should never input your private PIN number online when prompted for the CVV.

How do AVS and CVV Combat Fraud?

If a fraudulent actor only has access to a credit card number, they’ll struggle to surpass AVS and CVV authentication. This significantly lowers the likelihood of unauthorized purchases. That being said, implementing AVS and CVV does incur in additional cost. Merchants aren’t obligated to include these security systems for card-not-present transactions, but the potential savings when confronted with fraud, makes it a highly recommended practice.

How do AVS and CVV Affect Your Rates?

The implementation of AVS has the added benefit of reducing Interchange rates. As stated previously, there is a nominal cost associated with running a credit card AVS, but transactions become eligible for lower rates when it’s used. On the other hand, incorporating CVV into the process does not lead to a reduction in Interchange rates.

Interchange rates increase for riskier transactions as an effort by card brands to minimize fraud. Neglecting to incorporate any fraud prevention measures in card-not-present transactions essentially leaves your business vulnerable. By utilizing credit card AVS and CVV, you can effectively identify most fraudulent transactions, resulting in improved rates and fewer challenges for your business.

For more information on how to best protect your business and certified secure payment processing solutions, contact our experts at 787-774-1555 or visit us at www.acceptapayments.com.